Xrqute

New member

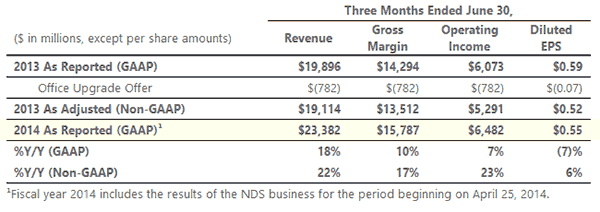

Microsoft amassed $23.38 billion in revenue between the dates of 1 April 30 June

From the amassed $23.38 billion it made $6.48 billion as pure profit. All the cream.

Microsoft acquired by 25 April , had a negative impact on the financials, losing $692 million. However compared to last year's figures Microsoft still managed a positive seven per cent growth in profits.

Microsoft's business Movers' and Shakers' in the most recent quarter we see that:

-Windows OEM revenue was up 3 per cent for consumer devices

-Windows licensing revenue grew by 11 per cent in the commercial sector

-Office 365 subscribers grew by 1 million to 5.6 million

-Bing search revenue grew 40 per cent

-Commercial cloud revenue rose by 147 per cent

In Microsoft's new 'Phone Hardware' division we saw the following highlights:

-Revenue contribution of $1.99 billion (but overall it lost $692 million)

-Lumia smartphone sales of 5.8 million units – mainly "devices at lower price points"

-30.3 million feature phones were sold

With Intel and Dell both foreseeing an upturn in enterprise PC sales in 2015 Microsoft should also benefit from this refresh cycle, with stronger Windows and Office sales/subscriptions.

Here are some exerts that have been Quoted directly from the FY14 Q4 Press Release, The Press Release shall also be linked below.

http://www.microsoft.com/Investor/E...s/PressReleaseAndWebcast/FY14/Q4/default.aspx

About Microsoft

-Founded in 1975, Microsoft (NASDAQ “MSFT”) is the worldwide leader in software, services, devices and solutions that help people and businesses realise their full potential.

Business Outlook

-On July 17, 2014, Microsoft announced a restructuring plan to streamline and simplify its operations and align the recently acquired NDS business with the company’s overall strategy.

Forward-Looking Statements

Statements in this release that are “forward-looking statements” are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors such as:

-intense competition in all of Microsoft’s markets;

-increasing focus on services presents execution and competitive risks;

-significant investments in new products and services that may not be profitable;

-acquisitions, joint ventures, and strategic alliances may have an adverse effect on our business;

-impairment of goodwill or amortizable intangible assets causing a significant charge to earnings;

-Microsoft’s continued ability to protect its intellectual property rights;

-claims that Microsoft has infringed the intellectual property rights of others;

-the possibility of unauthorized disclosure of significant portions of Microsoft’s source code;

-cyber-attacks and security vulnerabilities in Microsoft products that could reduce revenue or lead to liability;

-disclosure of personal data that could cause liability and harm to Microsoft’s reputation;

-outages, data losses, and disruptions of our online services if we fail to maintain an adequate operations infrastructure;

-government litigation and regulation that may limit how Microsoft designs and markets its products;

-potential liability under trade protection and anti-corruption laws resulting from our international operations;

-Microsoft’s ability to attract and retain talented employees;

-adverse results in legal disputes;

-unanticipated tax liabilities;

-our hardware and software products may experience quality or supply problems;

-exposure to increased economic and operational uncertainties from operating a global business;

-catastrophic events or geo-political conditions may disrupt our business; and

-adverse economic or market conditions may harm our business.

Devices and Consumer (“D&C”)

Total D&C revenue increased $2.98 billion or 42%, including $1.99 billion of Phone Hardware revenue following the completion of the NDS acquisition. D&C gross margin increased $1.32 billion or 37% over the prior year, which included the Surface RT inventory adjustment charge of approximately $900 million.

D&C Licensing

D&C Licensing revenue increased $406 million or 9%, due to the recognition of $382 million from the conclusion of the commercial agreement with Nokia and higher revenue from Office Consumer and Windows OEM, offset by a decline in royalty revenue. Gross margin increased $526 million or 14%.

-Windows OEM revenue increased 3%, as Windows OEM Pro revenue increased 11% and Windows OEM non-Pro revenue decreased 9%. Businesses continue to demonstrate their strong preference for Windows, and D&C Licensing results were again driven by business PC growth in developed markets, and benefits from Windows XP end of support that moderated throughout the quarter.

-Office Consumer revenue increased $125 million or 21%. We continue to outpace overall consumer PCs as developed markets, where more consumers buy Office with their PCs, outperformed emerging markets. Microsoft ended support for Windows XP in April 2014, which also contributed to our growth, as small businesses upgraded their PCs and purchased new versions of Office through consumer channels.

With free licensing for sub 9-inch devices and the new Windows with Bing offering, we are helping our partners bring new low-cost devices to market. We are encouraged by the initial response from OEMs, and expect many of these new devices to be available in time for the holiday season. During Computex in June, our OEM partners announced nearly 40 new devices, including all-in-ones, laptops, two-in-ones, and smartphones, demonstrating continued innovation on the Windows platform.

Computing and Gaming Hardware

The D&C Hardware segment was renamed Computing and Gaming Hardware in the fourth quarter of fiscal year 2014. Computing and Gaming Hardware revenue increased $274 million or 23%, driven by higher Surface and Xbox Platform revenue. Gross margin increased $665 million compared to the prior year, which included the Surface RT inventory adjustment charge. Current year cost of revenue included Surface inventory adjustments resulting from our transition to newer generation devices and a decision to not ship a new form factor.

-Surface revenue was $409 million, driven by our second generation Surface 2 and Surface Pro 2 devices, and the recent launch of Surface Pro 3.

-Xbox Platform revenue increased $104 million or 14%, driven primarily by increased console revenue. We sold in 1.1 million consoles in the fourth quarter, as we drew down channel inventory, compared to 1.0 million consoles during the prior year.

We launched Surface Pro 3 in the U.S. and Canada on June 20, and it will roll out to additional markets beginning in the first quarter of fiscal year 2015. This new device is optimized for productivity and highlights the progress we have made bringing hardware and software together.

During the E3 conference in early June, we highlighted several new titles that will be available exclusively on the Xbox Platform. We also launched a lower-priced console without the Kinect sensor to provide additional choice to our customers, and are planning to offer Xbox One in additional markets beginning this fall.

Phone Hardware

Phone Hardware revenue was $1.99 billion, reflecting sales of Lumia Smartphones and other first-party non-Lumia phones following completion of the NDS acquisition. Cost of revenue was $1.93 billion, including amortization of acquired intangible assets and the impact of decisions to rationalize our device portfolio, resulting in gross margin of $54 million.

-We sold 5.8 million Lumia Smartphones, and 30.3 million non-Lumia phones following the completion of the NDS acquisition. Low price point devices drove a majority of the Lumia Smartphone volumes. Non-Lumia phone volumes performed in line with the market for this category of devices.

D&C Other

D&C Other revenue increased $317 million or 20%, due mainly to increases in search revenue and Office 365 Consumer subscriptions. Gross margin increased $78 million or 21%.

-We continue to see strong adoption of Office 365 Home and Personal offerings, which added more than 1 million subscribers in the fourth quarter to total more than 5.6 million.

-Search revenue increased 40%, offset by an 11% decline in display revenue. Growth in search advertising revenue was due to higher revenue per search (“RPS”), increased search volume, and the expiration of North American RPS guarantee payments to Yahoo! in the prior year. U.S. search share grew again to 19.2%.

Our Bing platform continues to accrue value across our portfolio of products and services. The Bing search index is helping power several of our offerings, including the Cortana digital assistant, Xbox, and Power BI. Bing was also chosen as the default search provider for the upcoming release of Apple’s new OS X, providing additional opportunities to monetize the service.

Source:http://www.microsoft.com/Investor/E...s/PressReleaseAndWebcast/FY14/Q4/default.aspx

What do you think is ahead for the SUPER POWER that is Microsoft??

Discuss in the comments below!

One thing that amazes me is that this apparently their 7th straight year of positive growth......All this money they have at their disposal and they still haven't been able to get Win 8.1 right!

Last edited: